Recognizing accounts that don’t show up on the balance sheet is crucial for accurate accounting in any organization.

These accounts, known as off-balance sheet (OBS) items, are not included in a company’s balance sheet.

Off-balance sheet accounting serves various purposes, primarily to shield a company’s financial statements from the effects of owning assets and the associated liabilities.

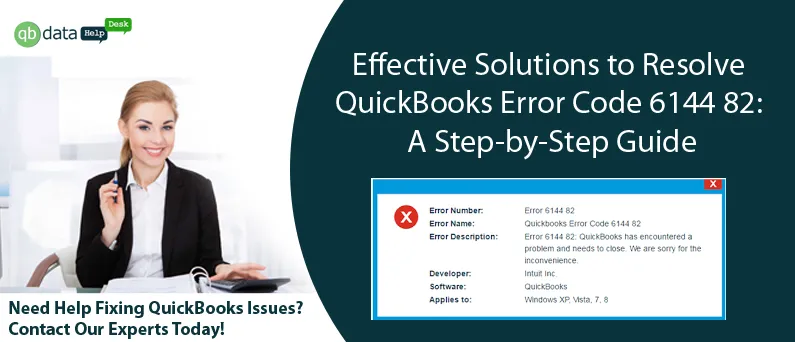

Read this also:- Resolving QuickBooks Error 6144-82: Your Ultimate Guide

Understanding the Hidden World of Off-Balance Sheet Items

Off-balance sheet items play a vital role in assessing a company’s financial health and often raise concerns for investors.

These items are usually detailed in the notes accompanying financial statements, making them somewhat difficult to identify and understand.

Moreover, certain off-balance sheet items may become undisclosed liabilities, which can be alarming for stakeholders.

Understanding the Mechanics of Off-Balance Sheet Financing

A typical example of an off-balance sheet item is an operating lease used in off-balance sheet financing.

Imagine a company with a line of credit from a bank, which requires the company to maintain its debt-to-assets ratio below a certain level as part of the financial agreements.

If the company takes on more debt to buy new computing equipment, it would breach the credit line terms by exceeding the agreed debt-to-assets ratio.

Types of Off-Balance Sheet Items

Off-balance sheet items come in various forms. Here’s a look at some common types:

Operating Lease

In an off-balance sheet (OBS) operating lease, the asset remains on the lessor’s balance sheet.

The lessee does not record the asset or its related liabilities on their balance sheet. Instead, they record the monthly lease payments and any additional leasing costs.

Often, the lease agreement includes an option for the lessee to purchase the asset at a significantly reduced price at the end of the lease term.

Leaseback Agreements

A leaseback arrangement allows a company to sell an asset, such as real estate, to another party and then lease it back from the new owner.

Like an operating lease, the company only records the lease payments on its balance sheet, while the asset itself is listed on the balance sheet of the new owner.

Accounts Receivable

Accounts receivable are also considered off-balance sheet items. These assets, common in nearly every business, carry a significant risk of non-payment.

These are funds that have been billed but not yet collected from customers, presenting a substantial default risk.

To avoid showing this risky asset on their balance sheets, companies may choose to sell their receivable accounts to a third party, known as a factor, who then takes on the associated risk.

Examples of Accounts Not Appearing on the Balance Sheet

Consider a scenario where a company uses off-balance-sheet financing to acquire necessary equipment without having enough cash on hand.

If the company needs to purchase equipment but taking out a loan would significantly worsen its debt-to-equity ratio, potentially deterring investors, it might choose to lease the equipment through an operating lease.

In this case, the company records only the monthly lease payments, avoiding the need to list an asset or liability on the balance sheet. The lease expense appears on the income statement, effectively keeping the asset and any associated liability off the balance sheet.

Benefits of Off-Balance Sheet Financing

Off-balance sheet financing can improve a company’s financial appearance as it doesn’t directly impact the balance sheet like loans do, which can deter investors due to the apparent increase in liabilities.

Since off-balance sheet items do not appear on financial reports, they do not affect the company’s ability to raise funds. These items are owned by third parties and typically pose no risk to the company. For instance, leasing an item instead of purchasing it through a loan shifts the risk to another party, reducing long-term financial risks for the company.

This approach allows the company to access the necessary equipment without increasing its debt burden, thereby preserving its borrowing capacity for other uses.

Drawbacks of Off-Balance Sheet Financing

Off-balance sheet financing can give investors and financial institutions a misleading impression of a company’s financial health. This has prompted the creation of various laws and regulations to ensure transparency.

The risk of misinformation means that investors and lenders often seek more detailed information than what is shown on the balance sheet to fully understand a company’s financial health.

While off-balance sheet financing is a legitimate and legal accounting practice, it must be conducted within legal constraints to avoid misleading stakeholders.

Final Thoughts

If you’re encountering accounting challenges and need expert help, QB Data Service is here for you. Our helpline offers comprehensive support for all your QuickBooks needs, from data management and troubleshooting to optimizing software usage. Whether you’re setting up for the first time or dealing with complex accounting issues, our customer service team is dedicated to ensuring your financial operations are seamless and efficient. Reach out today and enhance your QuickBooks experience with our dedicated support.

Comprehensive FAQs on Off-Balance Sheet Financing

Off-Balance Sheet Risk refers to potential liabilities and assets that are not recorded on the balance sheet but could have significant financial implications. This risk is often linked to items like operating leases, where the liabilities are not directly shown on the balance sheet.

Off-Balance Sheet items are usually mentioned in the footnotes of financial statements. They must be disclosed here to provide a complete understanding of the financial commitments that are not visible on the main balance sheet.

Examples of off-balance sheet items include operating leases, leaseback agreements, and certain types of derivative instruments. These items are not directly owned by the company or considered its direct responsibilities, yet they influence the company’s financial operations.

An off-balance sheet transaction involves commitments or resources that do not appear on the balance sheet. This might include agreements like operating leases, where the asset is legally owned by another entity, yet the company benefits from its use.

Off-balance sheet financing is legal under GAAP as long as it meets specific classification criteria. It often involves debt that, due to its structure, does not appear as a liability on the balance sheet, thereby not affecting the company’s reported debt levels.

Off-balance sheet financing can significantly affect a company’s financial ratios, such as the debt-to-equity ratio and return on assets, by excluding certain liabilities or assets from the balance sheet. This can make a company appear financially stronger than it actually is.

Yes, there are regulatory concerns because off-balance sheet financing can obscure a company’s true financial state, potentially misleading stakeholders. Various regulations and standards aim to ensure transparency and proper disclosure of these items.

Investors generally approach off-balance sheet items with caution, as these can signal potential hidden risks not immediately visible from the balance sheet alone. Astute investors often delve deeper into financial notes and disclosures to grasp the full extent of these items.

Strategically, off-balance sheet financing enables companies to acquire assets or enter into leases without negatively impacting their leverage ratios. This helps maintain better borrowing terms and credit ratings.

![QuickBooks Error H202 Troubleshooting: [ Effective and Updated Fixes ]](https://qbdatahelpdesk.com/wp-content/uploads/2024/12/h2o2.webp)